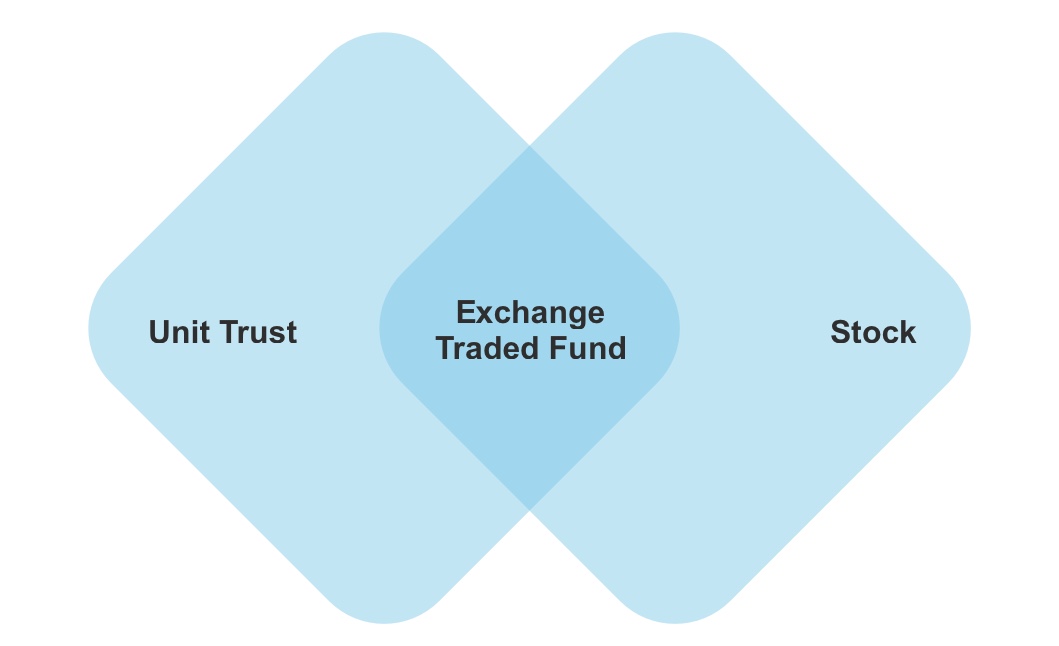

ETFs hold a basket of securities to track performance of a specific index. Unit trust funds also hold a portfolio of assets. Nevertheless, both funds have marked differences.

The main differences between ETFs and unit trust funds are:

ETF | Unit Trust | |

|---|---|---|

| Investment Objective |

|

|

| Buy and Sell Transactions |

|

|

| Cost to invest |

|

|

| Minimum Investment Amount | No |

|

| Continuous trading and pricing throughout the trading day? | Yes | No |

| Prospectus available? | Yes | Yes |

| Can be purchased online? | Yes | Yes |

| Redemption charges for withdrawals | No | Yes |

| Possible to view the underlying securities? | Yes | No |

| Possible to receive dividends? | Yes | Yes |

* Only for specific unit trust i.e. through a bank

** Only for specific unit trust funds, typically bond funds.

*** Most funds only reveal their top ten holdings.

Source: Bursa Malaysia

ETFS | Stocks | Unit Trust | |

|---|---|---|---|

| Diversification | |||

| Real-time dissemination | |||

| Trade via | Broker | Broker | Agent |

| Purchase of ETF / Stocks / Unit Trust | T+3 | T+3* | Upfront |

* T+3 means the 3rd market / business day after trade date.